Bridge the Gap Between

Capitol Hill & Wall Street

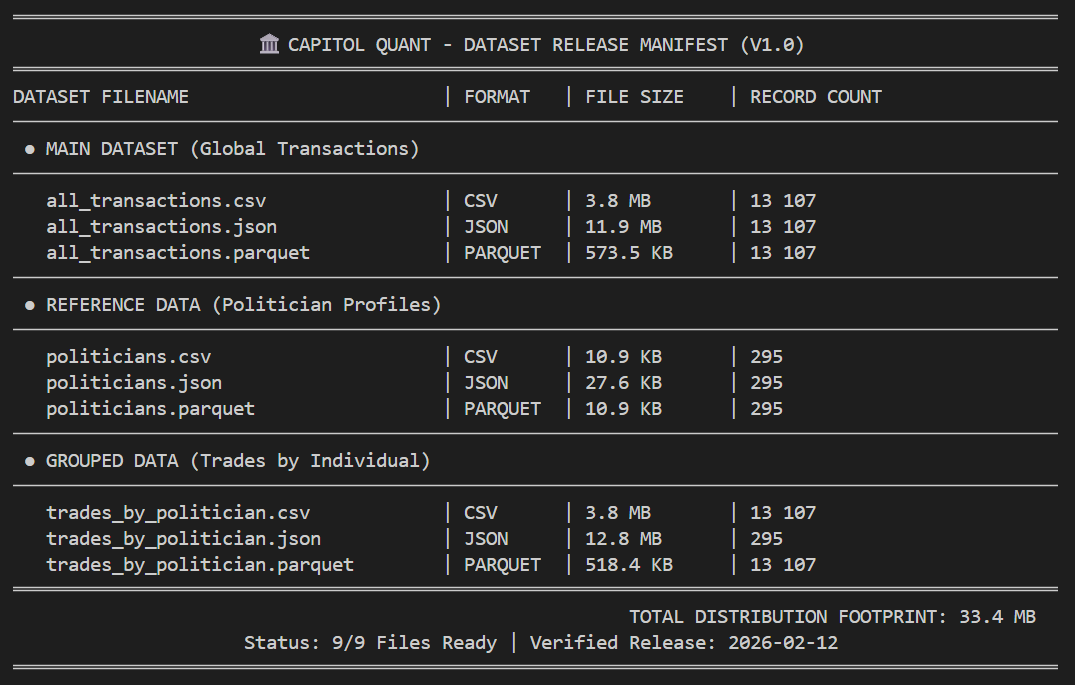

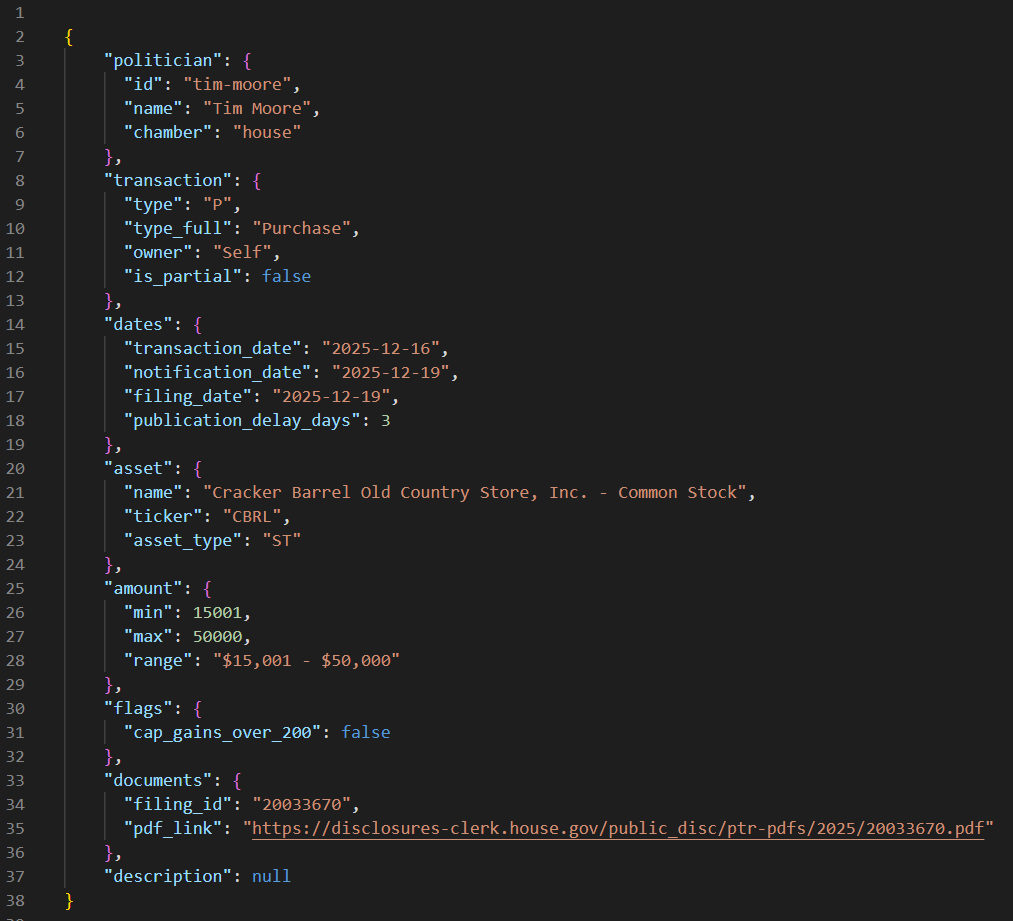

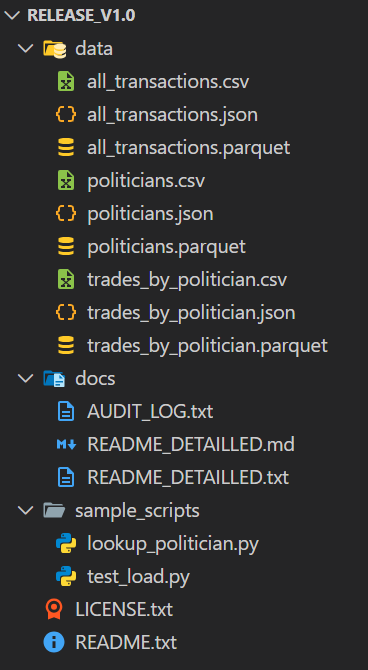

Stop digging through PDF filings. Access 13,107 validated, high-value transactions (> $15k) from 2015 to 2026. The only dataset that transforms messy GovTrades disclosures into machine-readable financial intelligence.

The Market Inefficiency

Members of Congress consistently outperform the S&P 500. Yet, their trading data is buried in thousands of unreadable PDFs, making it impossible for retail investors to track in real-time. We fixed that. This archive democratizes 10 years of insider history.